The drama surrounding President Trump’s decision to impose import tariffs on steel and aluminum has roiled the Republican Party and wide swathes of the corporate elite. The tariff decision comes on the heels of political bluster about the US being treated “unfairly” by other countries. This accusation of “unfairness” when it comes to US trade deficits is well worn. In a previous era, Japan was the alleged culprit of “unfair” trade practices because of its persistent trade surpluses with the U.S.

This type of political theater draws on a romanticized view of international trade and its persistent conflict with empirical reality. As an explanation of global trade relations, the Heckscher-Ohlin-Samuelson (HOS) model of foreign trade relies on both of the standard neoclassical assumptions about “efficient” markets. First, it assumes perfectly competitive markets, composed of many, small firms, each without any ability to set prices. Second, it assumes that there are zero externalities to economic transactions, meaning that transactions do not have any un-priced, third-party effects. And of course, the model assumes the economy is fundamentally based on barter, according no roles for money, credit, and effective demand. The absence of money implies that there is no possibility of an increase in liquidity preference (a term coined by Keynes to describe the desire to hold cash rather than illiquid assets) in uncertain times and thus no possibility of shortfalls of effective demand. Together, these propositions of the HOS model predict that a legal framework of “free trade” will produce balanced trading relationships on the international level and full employment in each domestic economy. Significantly, assuming that there is perfect competition implies that firms in each country, regardless of its level of industrialization, have access to the same technology needed to produce goods for the international market. Perfect competition implies that no firm injures others, a point of view that has been challenged by many authors. (See the edited volume by Moudud, Bina, and Mason Alternative Theories of Competition: Challenges to the Orthodoxy). The core aspect of the broad alternative perspectives is that firms do seek to damage each other by attempting to take away market shares via price-setting and cost-adjusting processes. This has nothing to do with either “perfect” or “imperfect” markets.

That none of these assumptions or conclusions is consistent with empirical reality does not appear to trouble neoclassical economists, who persist in upholding the HOS trade model as a benchmark in policy discourse. For example, this trading regime is clearly not producing full employment: The International Labour Organization reports that unemployment in 2015 was around 197.1 million and estimates that unemployment will be close to 200 million by 2017. Further, trade imbalances tend to be persistent.

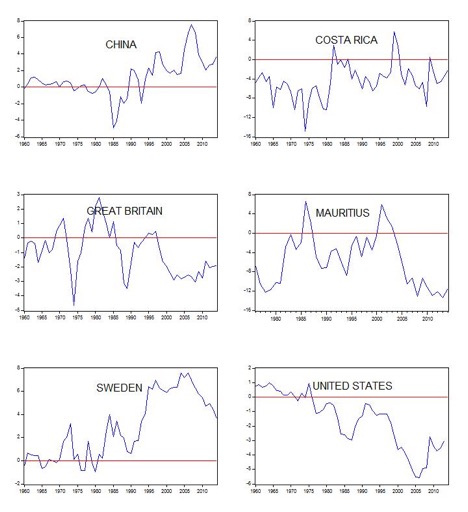

The charts below, drawing on World Bank data, show two things.

First, actual trade balances tend to persistently deviate from balanced trade (corresponding to the red line); trade-deficit countries experience persistent shortfalls in global effective demands for their exported products. Second, both trade deficits (Costa Rica, Mauritius, and Great Britain) and trade surpluses (Sweden) can be consistent with well-developed welfare states. Thus, global integration and unbalanced trade do not necessarily entail a “race to the bottom.”

In the neoclassical paradigm, government “interference” in the market can only mess up the romantic market story of the HOS model, unless “market failures” prevail. Even “liberal” commentators, such as Jagdish Bhagwati and Paul Krugman, still recommend relatively-laissez faire policies so as to minimize the role of politics.

The problem with this model of trade is that it reflects a deeper problem with the neoclassical conception of markets and, implicitly, the nature of property relations. At its core the completely unrealistic theory of perfect competition constitutes the foundation of the model in which each firm is conceptualized as an isolated entity whose actions have no impact on other firms. Implicitly, this Robinson Cruso-esque view reflects an early perspective of property in which the sic utere principle prevails: That is, everyone is assumed to have the right to use her property however she pleases, without injuring others. Implicitly, this principle assumes that such a type of property can exist.

But this romanticized view of property was later challenged by legal scholars, especially those in the Legal Realist school. Two core issues emphasized by the Realists, pertinent to the current essay, are important. First, they rejected Blackstone’s view of property as one’s “sole and despotic dominion.” The Legal Realists emphasized the social and political nature of property, which was recognized, in the words of Morris Cohen, as a “relation not between an owner and a thing, but between the owner and other individuals in reference to things.” In short, the Legal Realists rejected the in rem view of property, recognizing that property needs to be defined in terms of the effects of its use (or non-use) on others. And of course, as Wesley Hohfeld argued, the juridical relations of property would determine the nature of this social interaction of the property owner with others.

Second, as Robert Hale argued, conceptualizing property as a structure of legal institutions that are politically enforced automatically implies that the economy is a network of coercive relations with inequalities of power built into its structure. Inequalities between firms competing in markets and of course between capitalists and workers will be persistent.

These two Realist propositions have devastating consequences for neoclassical economic theory. To begin with, they imply that private actions will always have social consequences. This is evident from the Hohfeldian point that juridical relations that are bipolar, so no one’s property can be an island unto itself. Further, the fundamentally coercive nature of property implies that business competition is a form of legalized injury. However, injurious behavior is precluded under perfect competition since no firm would engage in price- and cost-cutting behavior or advertisements as deliberate attempts to increase its market share at the expense of others. This entirely passive character of perfectly competitive markets implies the absence of any coercive power of firms over each other. Each firm is an isolated Robinson Cruso-esque entity, implicitly behaving in a way that is consistent with the sic utere principle. At a theoretical level such a view has been criticized by many authors, including Austrian economists Friedrich Hayek and Joseph Schumpeter, while the perfect competition model has been shown to be inconsistent with Adam Smith’s theory of business competition and, as P.W.S Andrews and others in the Oxford Economists’ Research Group showed, inconsistent with real-world business behavior. Neoclassical textbooks often claim that the perfect competition model is applicable to global grain markets. However, the global grain market is actually dominated by five multinational corporations, and so it lacks any of the features of the perfect competition model.

In his classic book, The Transformation of American Law 1780-1860, Morton Horwitz argued that shifts in legal conceptions of property in the early nineteenth century revolved around the fundamentally destructive and coercive nature of business competition. This led jurists to recognize the principle of damnum absque injuria, i.e. the commission of injury which does not require compensation. Finally, as Warren Samuels observed in his classic essay on Hale, , externalities are ubiquitous, given the social/political nature of property. This suggests that market failures are also ubiquitous. But if market failures are ubiquitous, the neoclassical portrayal of market imperfections as exceptional deviations from an idealized, perfectly competitive market cannot be right. Markets are bundles of politically-enforced legal institutions tout court. They are neither perfect nor imperfect, but constructed through political relations and legal institutions.

What are some of the implications for international trade? First, international competition between firms located in different countries will generate inequalities in trade performances, because they have different cost structures and product qualities. This conclusion, which can be derived from the theories of Adam Smith, Karl Marx, John Maynard Keynes, and Roy Harrod (see Anwar Shaikh’s Capitalism: Competition, Conflict, and Crises) is consistent with the Legal Realists’ view. As Duncan Kennedy observed in connection with Robert Hale’s framework, different types of background laws will shape distributional outcomes and thus cost structures (e.g. unit labor costs). Laws and politics always structure market outcomes, because they give shape to the background property relations from which markets spring. In short, mainstream international trade disputes rest on an idealized view of markets as free of “state interference,” when politics actually intrudes through legal arrangements at every step of the way in the demand/supply relation.

Second, finger pointing about “unfair” policies by others obfuscates the reality of politics and the law in structuring markets, money, and international competitiveness. The political nature of capitalist markets, emphasized by the Legal Realists, correlates well with the profoundly intertwined relationship between states and markets that one sees in capitalism across the world. Contrary to the barter-based model, money is integral to markets and fundamentally shaped by law and politics. I have described this dynamic in the context of state-led industrialization and exports. Seen in this light, numerous public policies (e.g. labor laws or infrastructure projects) benefit export sectors in intricate ways, and so trade policy is always already politicized.

At the end of the day, tariffs intended to save specific US industrial jobs, coupled with shrill finger pointing, only make for political theater. If the question of US jobs is to be taken seriously with the simultaneous revival of US industry, a new type of state-market configuration needs to be conceptualized. Nothing in my view suggests a negative view of import tariffs, contrary to the standard media coverage. Rather, my view is that tariffs should be part of a broader policy mix with the goal of improving export performance, along with strengthened labor and social rights as well as environmental protections. As the figures above show, various trade balances can be consistent with different social policy frameworks, including those that strengthen social democracy. In short, markets are always shaped by politics, even where they purport to be unmanaged, laissez faire arrangements. But so long as neoclassical economic theory remains the dominant framework for debating economic governance, these political choices and power relations will remain invisible, and political theater will reign supreme.