Public corporations have been dominant institutions in the American economy since the dawn of the 20th century. Whether due to their greater efficiency or power, listed corporations spread across nearly all industries. “Capitalism” in America was synonymous with “corporate capitalism,” and the number of exchange-listed companies grew with the size of the economy.

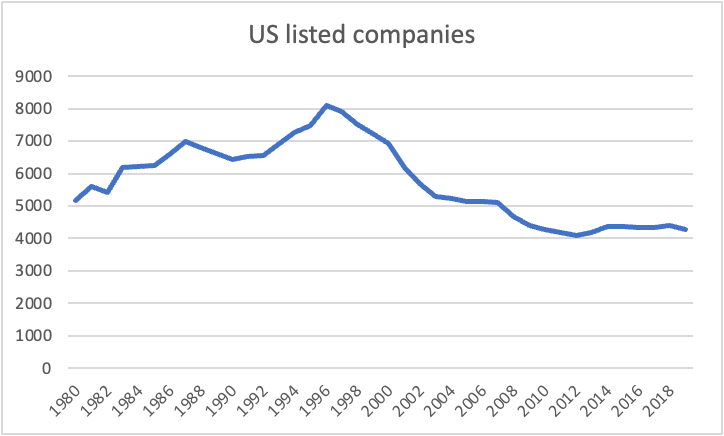

Yet since the late 1990s, the number of listed corporations has dropped by half in the US, underwritten by new technologies that lower the cost of assembling an enterprise. Meanwhile, neglected alternatives to the public corporation both old (e.g., mutuals, cooperatives) and new (e.g., open source, platform coops) have proven surprisingly durable. Given the manifest pathologies of shareholder capitalism, the combination of these two trends may suggest pathways out of our current dilemma.

The Vanishing American Corporation

Since 1997, the number of listed corporations in the US has declined almost continuously. By 2010 there were about half as many as at the peak year of 1996, and it has not gone up since.

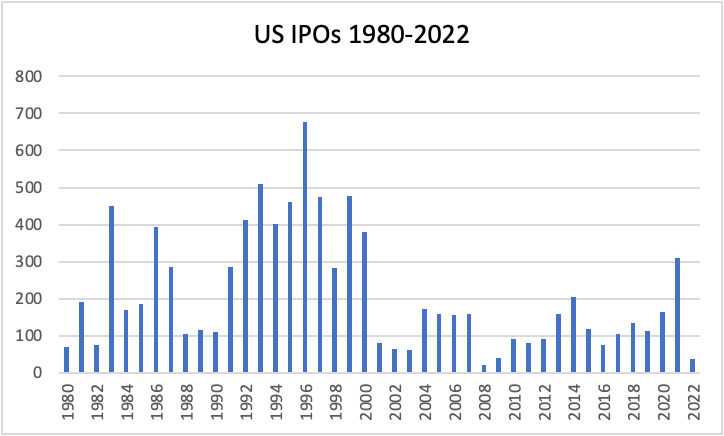

There are several possible reasons for this. Perhaps Sarbanes-Oxley, the 2002 law that increased disclosure and auditing requirements, made it too costly to go public? No: the JOBS Act of 2012 reduced the cost of IPO for most firms but had a fairly trivial impact on new listings. Maybe comatose antitrust enabled oligpolists to gobble up their rivals? In spite of the popularity of this narrative, it accounts for at best a fraction of the listings drought. A third possibility is the rise of private equity, which assembles pools of capital large enough to take large market cap companies private. This accounts for many exits by public companies, particularly since the 2008 financial crisis. Assets under management by private equity have reached roughly $12 trillion. But it does not explain why there are so few new listings, particularly given the successive waves of new industry creation.

A more encompassing interpretation is that information and communication technologies (ICTs) have drastically changed the basic economic calculus of what an enterprise looks like and how it might be funded. In the US context, this has meant that companies prefer “buy” to “make,” as transaction cost enthusiasts might describe it. I coined the term Nikefication to describe the process of vertical dis-integration that reconfigured American industry during the 1990s and 2000s and the options it opens for alternative forms of enterprise, described in detail in previous books.

Asset- and employee-lite models are widespread in today’s economy. Zoom grew to become a global behemoth serving 300 million daily users–with just 8000 employees and server space rented from Amazon and Oracle. Streaming giant Netflix has facilities in 65 countries but only 12,800 employees globally, and states that “we run the vast majority of our computing on AWS.” Vizio became the best-selling television brand in America in 2007, beating Sony and Samsung, with just 200 employees in Irvine, California, enabled by a Taiwanese assembler and big-box retailers. ”Automaker” Fisker went public on the New York Stock Exchange in late 2020 with a plan to contract out manufacturing of its first models to Magna and Foxconn, thus becoming the Nike of the auto industry. Today, it has just 850 employees and a $2 billion valuation.

The vertical dis-integration of the American economy was driven by Wall Street and enabled by ICTs. Ironically, the result is that the capital requirements to create and scale a business can be much lower, reducing the rationale to go public in the first place. Indeed, IPO prospectuses routinely convey that the point of the IPO is not to raise capital, but to create a market for the company’s shares to enable VCs and employees to cash out – which is not the most persuasive pitch to potential buyers, and perhaps helps account for the disastrous post-IPO performance of most new listings.

The Surprising Resilience of Noncorporate Forms

The asset-lite model means fewer public companies, but it also suggests new possibilities for non-corporate forms that may be more human-scale and democratic. Nike’s profit-driven, asset- and employee-lite model is not the only option enabled by new technologies.

By “noncorporate” I mean forms of economic organization that are not owned by outside shareholders, although they may be legally organized as a corporation. These include mutuals (where consumers or members are also the owners); cooperatives (where workers, producers, or consumers are the owners); municipal enterprises (where citizens or governments own the enterprise); nonprofits; and open source projects. These forms are far more prevalent than one might expect, and in some cases they dominate their industry (e.g., property insurance, server software).

Noncorporate forms of enterprise have proven surprisingly resilient in the US. The Fortune 500 list for 2022 includes at least a dozen mutual insurance companies, including State Farm (#44), New York Life (#71), and Nationwide (#83). The single largest shareholder of over 350 of the 1000 largest American corporations is Vanguard—also a mutual. Land o’ Lakes (#213) is an agricultural cooperative owned by its producer-members, as are Ocean Spray and Blue Diamond. Ace Hardware is a retail cooperative in which local stores can be attuned to local needs and tastes yet gain the economies of scale of a large-scale brand. Jessica Gordon Nembhard’s brilliant book Collective Courage documents that cooperative forms thrived in African-American communities for generations – often overlooked by those who find data about the economy solely through online databases. And the US is home to nearly 5000 credit unions, which by law are not-for-profits, owned by their members.

Stanford Law professor Ron Gilson once quipped that if shareholders didn’t exist, they would have to be invented. That’s not quite true: plenty of American enterprises do quite well without shareholders. Indeed, civilization itself might be better without them. As I have written elsewhere, “nearly every major societal pathology in the West today – certainly in the USA – is caused or exacerbated by profit-oriented corporations,” including the opioid epidemic, the obesity crisis, the return of nicotine addiction among the young, democracy-undermining social media, and a climate catastrophe underwritten by the fossil fuel industry. Shareholder capitalism may be a suicide pact. Conversely, cooperatives are inherently democratic and accountable.

Have Cooperative Forms Finally Found Their Moment in the US?

Institutional alternatives to public corporations are well-established in the US, and in some cases they lead their industry, such as mutuals in finance and insurance. But cooperatives have historically been thin on the ground here compared to Europe. According to the Democracy At Work Initiative, there were 612 worker cooperatives in 2021 –a 30% increase over 2019, but still a tiny number.

Perhaps the digital revolution has finally created the conditions for cooperatives to thrive. Research from the pre-digital era suggests that one of the factors limiting cooperatives is, for want of a better term, the transaction costs of democracy. A lot of workers’ time spent in meetings to engage in dialogue, debate, and polling is a price that corporate dictatorships don’t have to bear. But newer tools have dramatically reduced the transaction costs of democracy: the same smartphones that enable pervasive corporate surveillance also allow worker voice at scale on a continuous basis.

It is not just transaction costs that have declined: the required assets to start a business are also much cheaper now to own or rent. Capital equipment such as Computer Numerical Control tools, powered by software, gets better and cheaper much the same way other software-powered tools do. (Compare the price of a color laser printer in 1990 to one today.) This is also true of the software required to run an enterprise. It is possible to buy a knockoff version of the enterprise software underlying the Uber app for under $10,000 – and the Drivers Coop in New York is creating a version to “franchise” the locavore driver-owned coop alternative to Uber. The ICTs that dis-integrated the corporate economy have opened space for noncorporate alternatives that might be more democratic and human-scaled.

There are reasons for optimism here. Platform cooperatives merge the benefits of coops with accessible technology, and have been especially effective in industries in which the required new capital investment is low (home cleaning, home health aides, transit). Trebor Scholz’s new book Own This! provides details on the opportunities here. Municipally- or cooperative-owned fabrication facilities can enable enterprises with limited capital to launch and thrive. If the required investment to start a business is low, then the range of alternative institutions, including coops, is correspondingly larger.

The technologies exist to create low-cost alternatives to public corporations. Maybe we are not stuck with the legacy of 20th century corporate capitalism after all.