The expression “economic liberty” is a form of conceptual doublespeak. The word doublespeak refers to a kind of “language used to deceive usually through concealment or misrepresentation of truth.” This strategy of redefining reality with the clever use of language is central to the way in which power is exercised in Orwell’s dystopian novel 1984. But it also applies to the Public Choice Economics literature. It requires obeisance to the rule of law and “economic liberty,” while ensuring that the majority of the population cannot reduce the wealth of the richest few. This effect evokes a1984-like dynamic, well described in Nancy MacLean’s Democracy in Chains. MacLean describes how Public Choice’s libertarian ideology aims to restrain society’s ability to regulate the controllers of capital under the guise of “economic liberty.” And of course, a crucial goal is to contain the power of labor. The ideological justification as MacLean put it is that “[I]n a true, undistorted market society, wages should only rise with increases in productivity.”

One could rephrase MacLean’s conclusion a little by saying that in the neoclassical paradigm, wages will rise with productivity under “free markets.” This conclusion follows from marginal productivity theory (MPT). In MPT, production and distribution occur in a context devoid of politics, in which output arises from a technological relationship called the production function via the inputs of the capital stock and labor. Given perfectly competitive markets (meaning those populated by small firms without any ability to set prices of their products or influence wages), each firm chooses that level of employment in which the additional cost of hiring one more worker equals the revenue that the output produced by that worker generates. This ensures the condition that real wages equal the marginal product (additional product) produced by each worker, in line with the Lockean view that each person should live by the fruits of their labor. The supplies and demands for the aggregate labor and capital stocks, respectively, determine wages and profits, i.e. the economy’s endowment structure determines the distribution of the output that arises from the production function.

There are several theoretical and empirical problems with MPT, all of which are left deliberately unaddressed by the Public Choice School. The first one is an internal contradiction which became the basis of what is called the capital critique. It constituted an important debate that raged for several decades between heterodox economists at Cambridge University such as Joan Robinson, Piero Sraffa and neoclassical MIT economists like Robert Solow and Paul Samuelson. The capital critique essentially argues that MPT is fundamentally mistaken in concluding that the production function can explain a society’s distribution of income. Rather, the critique contends that the production function itself reflects the underlying distribution of income. In other words, because the capital stock is heterogeneous (tractors, trucks, blast furnaces, textile machinery etc.), one can only derive the aggregate capital stock input in the production function—and thus supply/demand relationship for capital—when one knows the price of each form of capital. However, each price is, by definition, equal to the sum of wages, profits, and materials costs that went into building that piece of fixed capital. Thus to obtain the production function, one would need to have prior knowledge about the reigning distribution of income. In short, the MPT is circular: One cannot derive a society’s income distribution from the production function and thus the economy’s endowment structure, because a particular assemblage of capital and labor depends on prevailing prices, which depend on the existing distribution of income.

The second problem is the assumption of perfect competition in both output and labor markets which implies that each small-sized firm is too insignificant to affect wages and prices. This core assumption is contradicted by the fact that prices are set by large corporations that seek to benefit from economies of scale. Furthermore, wages have always been the consequences of bargaining or struggles, which reflect political processes that MPT ignores. In short, legal, institutional and political contexts are crucial to determining the prices of goods and services as well as labor..

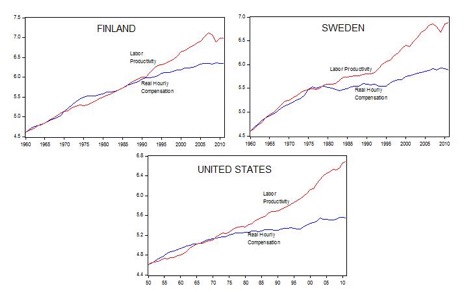

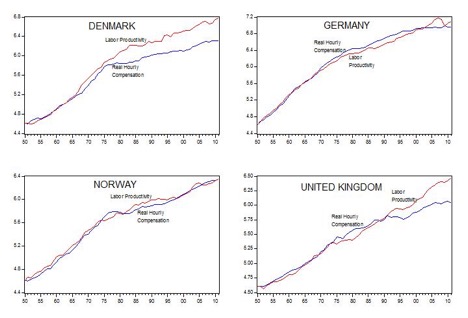

The third problem with MPT is empirical: The data doesn’t support MPT’s validity. The charts below plot manufacturing labor productivity versus real hourly compensation for several countries, using data from the Bureau of Labor Statistics. Three important features stand out:

- First, the relationship between real employee compensation and labor productivity generally tends to be an ambiguous one. Sometimes they move closely together and at other times they deviate quite significantly, with employee compensation growing more slowly than productivity. Profits, or what in national income accounts is called the gross operating surplus, account for the bulk of the difference between labor productivity and real employee compensation. So this lag in compensation represents an upward redistribution of the product of labor to the owners of capital, a violation of MPT.

- Second, in the situations when compensation and productivity do tend to move together, there has not been perfect competition in either product or labor markets. For example, in the US, the two variables have moved roughly together until about the early 1970s, a period in which the rate of unionization was higher, the real value of the minimum wage rose, and the post-war welfare state deepened its reach. In other contexts (e.g. Norway and Germany), parallel movements have been consistent with high rates of unionization and well-developed welfare states. And of course giant multinational corporations dominate all these economies.

- Third, the top three charts (Finland, Sweden, and US) show widening gaps between the two variables, despite very different background laws in regards to social and labor policies in the European countries compared to the US. On the other hand, compared to the above three countries the productivity-compensation gap is much smaller for Denmark and the UK, respectively, but relatively larger compared to Germany and Norway.

In sum, there is no deterministic link between the two variables for these countries all of which rank very highly in the World Economic Forum’s Global Competitiveness Index. In neoclassical terms, all of these would be considered close to the “competitive free market ideal.”

From a Law and Political Economy (LPE) standpoint, these patterns are unsurprising. Following Hale and Hohfeld, different combinations of background laws shift coercive power relations in the economy. And, by shaping the relative bargaining powers of workers and capitalists, these legal rules influence the relationship of employee compensation to productivity. Following Hale’s analytical framework, one could argue that welfare states provide workers with an alternative to employment-based benefits in a way that increases workers’ ability to resist employers’ coercive power over wages. Further, despite the relatively large productivity-wage gaps of the US, Finland, and Sweden, there are major institutional differences between the U.S. and the two northern European ones with regard to welfare state development and unionization. Moreover, the northern European countries show differences among themselves. Finland and Sweden on the one hand, and Norway and Denmark on the other hand, have different employee compensation /productivity gaps, suggesting important legal-institutional variations within the northern European models. Together these patterns exemplify Robert W. Gordon’s observation that “The same body of law, in the same context, can always lead to contrary results because law is indeterminate at its core, in its inception, not just in its applications.”

In sum, MPT has profound analytical and empirical problems. It is no surprise that the late distinguished neoclassical economist Frank Hahn concluded: “This [neo-classical] theory has nothing simple to offer in answer to the question why is the share of wages, or of profits, what it is? The question is prompted by our interest in the distribution of income between social classes, and social class is not an explanatory variable of neoclassical theory.”

Given the capital critique, LPE provides the appropriate framework to analyze the distribution of income. The libertarian paradigm is nothing but a reshuffling of coercive power in favor of the wealthy by a changing of the background laws. As I argued elsewhere, each period’s juridical relations determine a particular distribution of wealth and power and thus provide the basis for future challenges to the current economic structure. These power struggles, both as consequences and causes of the underlying legal infrastructure, determine particular wage/profit distributions. And as the constitutional theory of money recognizes, because distributional struggles entail money flows they are fundamentally structured by the economy’s politically enforced, legal foundations.

The highly influential Public Choice School engages in an elaborate process of gaslighting by concealing both the problems with its own analytical foundations and the inequality, social exclusion, and economic insecurity that its policies generate. After all, it is difficult to imagine that scholars such as James Buchanan were unaware of the capital critique, a debate raging between scholars at two major universities, or the types of data presented here. The empty rhetoric of “economic liberty” consists of the use of a type of political language that, in the words of George Orwell, consists “largely of euphemism, question-begging and sheer cloudy vagueness,” while providing “largely the defence of the indefensible.” And laissez faire is a useful type of doublespeak which deepens power inequalities without appearing to do so. It involves the naming of “things without calling up mental pictures of them.” The reality behind the facade is, of course, a motivation to return to the type of labor relations that prevailed during the Lochner era.