Is democracy compatible with vast disparities in material wealth? This question, which is as old as democracy itself, has gained renewed importance in contemporary democracies, where there is no lack of opportunity to transform money into political power. Money can be used to advocate or lobby in favor of specific policies. Wealthy individuals can acquire control of media outlets, which they can use to influence public opinion on political matters and public policy. And richer citizens are more likely to vote and tend to be better informed about political matters, so their preferences are less likely to be ignored by policymakers.

Yet perhaps the most direct way that money can be used to influence politics is through the financing of electoral campaigns. In American politics in particular, due to a rather lenient system of private campaign finance, wealthy donors often represent one of the largest sources of money for candidates to federal offices.

One obvious worry about this arrangement is that legislators’ dependence on such donations might induce them to overweight the political preferences of economic elites. And, indeed, empirical evidence seems to bear this out: as work by Martin Gilens has shown, public policy appears to be responsive to the preferences of Americans in the top ten percent of the income distribution but virtually uncorrelated with the preferences of the remaining ninety percent of the population, while more recent work has demonstrated that members of Congress respond to donations by catering to the political preferences of wealthy donors.

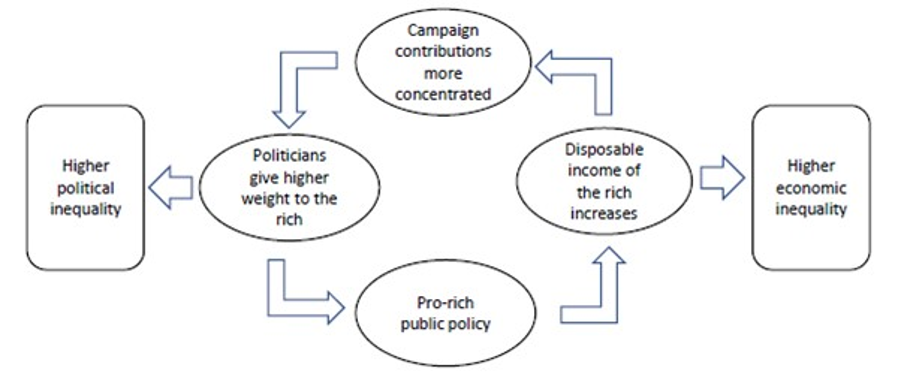

Since rich voters tend to be more conservative on economic issues, like taxation, social spending, and market regulation, this raises the worrying possibility that rich voters can steer economic policy in a direction that potentially creates greater economic inequality. In turn, greater economic inequality might induce even further concentration in campaign contributions and political influence. This would mean that, even in a democratic system, economic inequality and political inequality might mutually reinforce each other in a vicious spiral leading to an increasing concentration of both economic and political power in the hands of a small oligarchy.

Figure 1: The Inequality Spiral

A terrifying possibility, but do we have reason to believe it accurately characterizes our current democracies? As noted above, evidence of the influence of campaign contributions on public policy is gradually emerging in academic research. But what about the other thread of the spiral: does policy-induced higher disposable income lead to higher donations from top incomes?

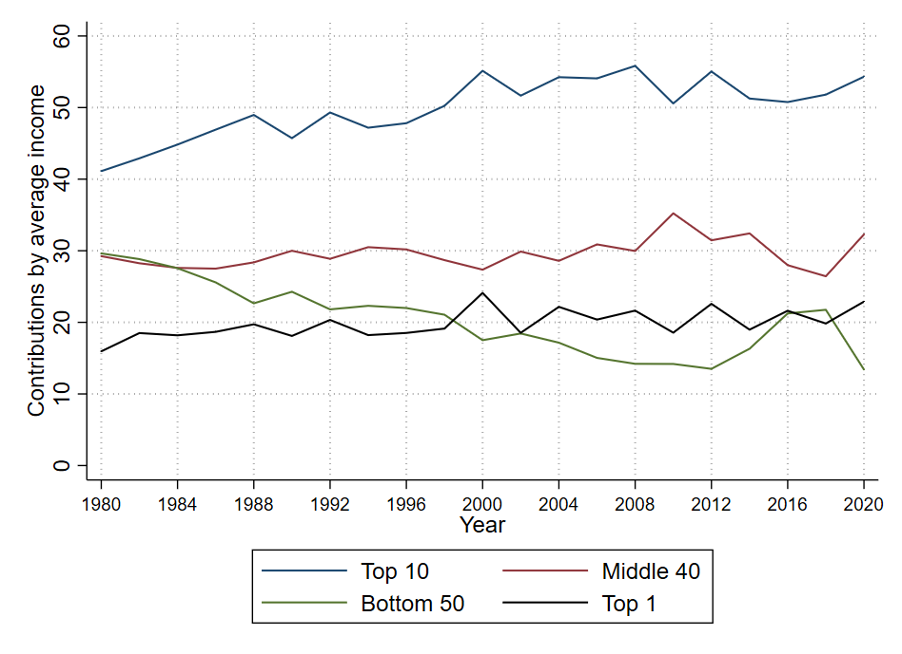

In our recent research, we attempt to tackle this question. First, we document that mirroring the general rise in income inequality (documented by Piketty and his collaborators, among many others), there has been a similar concentration in individual campaign contributions. Figure 2 shows that the share of campaign contributions coming from the richest ten percent of Census tracts went from about 40% of the total in 1980 to almost 55% in 2020. Meanwhile, the share of the bottom fifty percent of tracts halved, from almost 30% to less than 15%. The share of the richest one percent of tracts amounts to around 20% of total donations in the entire period, with a slightly increasing trend.

Figure 2: The rising concentration of individual donations

Second, we demonstrate that these two phenomena—rising income inequality and the concentration of campaign donations among the wealthy—are connected through public policy. To show this, we analyze the evolution of individual campaign contributions after Reagan’s 1986 Tax Reform Act (TRA). The TRA, which slashed the highest marginal tax rate from 50 to 28 percent, was one of the largest and most regressive tax cuts in the history of the United States. We find that the tax savings delivered by the TRA caused an increase in individual campaign contributions, and that this increase was largely driven by wealthy Census tracts and, within tracts, by taxpayers in the top ten percent of the income distribution, who experienced the largest increase in disposable income from the tax cuts.

Surprisingly, we find that politicians of the two main parties received a similar increase in donations. Likewise, the increase in donations appears unrelated to indicators of ideology or the way that legislators voted on the final TRA bill in Congress. However, legislators who were more likely to be socially well-connected (i.e., politicians with previous experience as lawyers or business professionals, or with a family member in Congress) or to come from a privileged background (i.e., legislators that attended a private high school or an Ivy-League university) benefitted more than other candidates from these donations.

This result tells us something about the motivation of donors. The larger gain for this group of “elite” candidates supports the interpretation of donations as driven by a “solidary motive”—that is, the enjoyment of interacting with like-minded and influential people that often belong to the same social milieu. For example, it is well known that many individuals donate when asked by friends or acquaintances. Large donors and recipients are indeed often part of the same social networks and are likely to share a preference for low taxes and other policies that increase inequality. Hence, the inequality spiral depicted in Figure 1 appears to be more rooted in social class than in partisanship or ideology.

Our findings show that policy decisions, such as tax cuts, have not only economic but also political consequences and can magnify the political clout of economic elites. This means that, even in democratic systems, the combination of regressive policies with a lenient system of political finance naturally creates the conditions for the mutual reinforcement of economic and political disparities. This combination lays the groundwork for a potential slide towards an oligarchic society, as it is shaped by social class and policies that safeguard the interests of economic elites.