This post is part of our ongoing series on climate, economics, and “green capitalism.” Read the rest of the posts here.

***

The most recent IPCC report confirmed climate policymakers’ worst fears: the world is still well on its way to catastrophic warming. As policymakers and activists continue to debate what must be done to avert the most damning effects of climate change, they face other, equally daunting questions: who or what has the authority to act collectively in the name of climate change? How will that allocation of authority impact who wins and who loses?

As the seas rise and wildfires rage, political theorists Geoff Mann and Joel Wainwright anticipate that many of these questions will be answered by what they call a “climate leviathan:” a liberal nation state or multi-state entity that will “declare an emergency and decide who may emit carbon and who cannot.” The authors point to the United Nations Framework Convention on Climate Change as the “first institutional manifestation” of the leviathan. We, however, envision climate authority in less herculean, and state-centric, terms: specifically, as emergent from the practices of physically dispersed public and private actors in the shared, networked, and ultimately banal business of risk assessment.

Networked Climate Authority

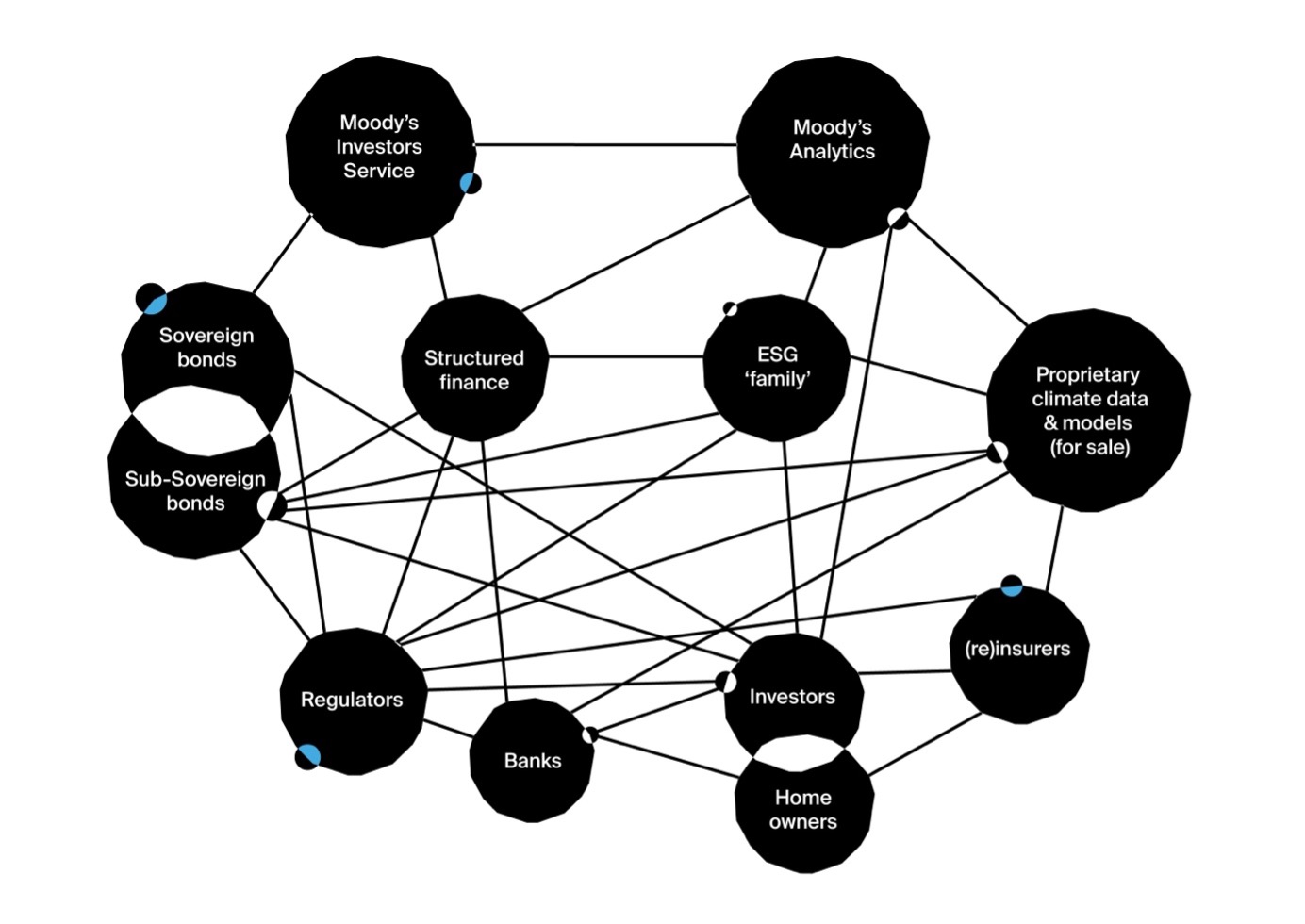

While seemingly removed from questions of sovereignty, the risk-rating practices of financial institutions have long shaped states and their behaviors—and have arguably gained significant power in recent decades as states and public regulators have opened up financial markets in their quest for capital. Rather than act through purely juridical means, these institutions—be they (re)insurance companies, bond rating agencies, or multilateral development banks—shape societal outcomes by producing risk scores, rates, and premiums that steer capital, and by extension, material investments on the ground. To understand how climate authority emerges from financial institutions, and how these institutions shape climate outcomes, we need to follow the hybrid public-private networks through which their knowledge is produced and instrumentalized.

Credit rating agencies are essential players within the network. Through the graded ratings they issue, agency analysts provide investors with a picture of a (local) state or corporation’s creditworthiness: that is, the likelihood that they will pay back their debt. Like many prominent actors in the global financial system, rating agencies and their respective ratings may seem detached from climate governance. But how these agencies evaluate climate risk in relation to creditworthiness, and how they circulate those evaluations to key nodes within their debt network, stand to have sweeping consequences for climate outcomes. The largest of the three rating agencies is Moody’s, whose investment and analytics arms rate the creditworthiness of state and corporate borrowers and provide economic research and consulting services. But lately, the agency has begun to make inroads on something else: assessing what climate change means for specific borrowers and debt markets writ large. By acquiring risk modelling firms or stitching together and circulating various forms of climate expertise and data sets, Moody’s is accelerating “the business of physical risk” across its vast, and admittedly complex, network.

Authority in Formation: Examples from Moody’s

To understand how and to what effect networked climate authority comes about, we turn to three key nodes in Moody’s’ network: municipal bonds, real estate finance, and banking.

We begin with municipal bond markets—the vast capital pools into which tens of thousands of municipalities, utilities, and other issuers tap to pay for vital infrastructure projects like schools, hospitals, and roads. Moody’s analysts rate the bonds of these issuers daily and determine the cost of debt issuance. Unsurprisingly, and as recent California wildfires laid bare, climate-exacerbated shocks throw borrowers’ ability to repay their debt into sharp relief—and along with it the stability of the bond market. Taking note, Moody’s recently announced that it had begun to incorporate climate vulnerability and resilience into its municipal bond rating practices. While the exact meanings of climate vulnerability and resilience are as varied as they are contested, Moody’s analysts largely define both in relation to existing categories of creditworthiness. For instance, what sorts of climate risks are the biggest threat to a borrower’s ability to repay? And over what period(s) of time? Are some municipal economies so sufficiently large and diverse that climate change is not, ultimately, all that important?

Analysts initially used public sources to answer questions like these but have increasingly turned to private companies like 427. Moody’s purchased the climate data firm in 2019 to integrate its precipitation- and temperature-based climate risk scoring method into its understanding of county- and city-level climate risk. Qualitative sources, like surveys sent to municipalities and phone interviews with municipal officials about climate risks and how they’re addressing them, also play important roles in shaping analysts’ view of a borrower’s climate vulnerability. Equally, and perhaps most importantly, these combined knowledge practices are beginning to prompt climate action at a local level: public officials across the U.S. have indicated that climate questions from Moody’s have made them feel more determined to act on climate change.

Property (re)insurance and real estate finance offer another important window into our story. In 2021, Moody’s announced the $2 billion purchase of Risk Management Solutions (RMS), one of the largest vendors of catastrophe risk models: actuarial tools that are widely used by (re)insurers to price risk and sell policies. The deal gave Moody’s access to RMS’s extensive proprietary model catalogue, and therefore secured it as a key arbiter within global (re)insurance networks. Through RMS, Moody’s now plays a crucial role in defining and pricing risks across the (re)insurance value chain—from everyday consumer policy underwriting to transnational risk financing, like property insurance-linked securitization. Moody’s now markets its climate expertise by, for example, helping institutional real estate investors to screen transactions for physical climate risks. As a demonstration case, Moody’s used RMS models to investigate properties underpinning a series of pools of commercial mortgage-backed securities valued at $368.7 billion. Moody’s leveraged the analysis to pose questions about the extent to which risks were adequately priced into transactions and implored would-be investors to scrutinise the insurance coverage and climate risk management on assets backing the highest-risk loans in pools. Moody’s’ offering comes to market just as institutional real estate investors look for ways to pin down climate risks within their portfolios and align their strategies with fast-coming industry and regulatory frameworks related to climate change and sustainability.

Beyond bond markets and real estate finance, Moody’s climate knowledge is now feeding into another crucial broker in global finance: central banks. Moody’s data is central to the climate scenario analyses that regulators increasingly undertake. In recent years, central banks have required regulated financial institutions to model the losses they could expect to accrue in the face of various hypothetical policy changes and physical climate events. At the Bank of England’s 2021 Climate Biennial Exploratory Scenario, for example, climate risk analytics firms like RMS played a key role. Throughout this regulatory exercise, the Moody’s subsidiary advertised its expertise in catastrophe and climate modeling to participating insurers, which gave some individual participants confidence in the exercise and provided a further imperative for action. While the Bank of England urged firms to be critical of the climate data purchased from third parties, the rapid spread of models from RMS to key regulatory bodies and financial institutions suggests that Moody’s’ climate authority—and specifically its private risk rating expertise—is rapidly spreading to public and private domains.

Challenging the Climatization of Sovereignty

You don’t need to be a fortune teller to understand the stakes of these developments; instead, you can turn to the experiences of frontline communities grappling with the ramifications of risk-rating practices today. Consider, for example, ongoing water challenges in South Africa: In 2020, rating agencies downgraded the nation’s credit rating due to the impact that the COVID-19 pandemic had on the economy. The downgrade has rendered the future of the nation’s debt-financed water infrastructure improvements highly uncertain, further destabilizing the lives of families already struggling to access water. South African water challenges speak to a key element of networked climate authority: rather than treat the planet as an object of collective “saving,” it becomes a surface of uneven risks, profits and losses to be navigated accordingly, with far too familiar winners and losers.

Just as money may pour out of South Africa, other vulnerable places may remain too valuable to forfeit to climate loss and damage—at least for now. In Miami Beach, Florida, public debt-financed efforts are underway to build costly infrastructure works that secure high-value properties. Importantly, this adaptation prospect is made possible by the city’s favorable status in the bond market despite its extreme, widely known climate vulnerability. Both cases prompt us to reflect on what we call the “climatization of sovereignty:” where instrumental forms of climate action inscribe new and deepened patterns of exploitative inclusion of climate-vulnerable places within global financial systems.

Rather than understand the climatization of sovereignty and the divergent climate pathways it produces as inevitable, we should treat them as opportunities for collective action—specifically regarding rating agency regulation. The aftermath of the 2008 Global Financial Crisis marked the last prominent opportunity to re-regulate the credit rating industry, whose failure to adequately scrutinize financially-engineered derivatives was viewed as a major contributor to that crisis. In light of these failures, a component of the Dodd-Frank Act permitted securities investors to sue rating agencies for “material misstatements or omissions” in the agencies’ rating opinions when they are included in registration statements and marketing materials for asset-backed securities. The rule was repealed after just one year in the statute book, but its content and eventual defeat provide important lessons for regulators as they draft rules on climate risk reporting, including penalties for its under- or over-evaluation among risk rating actors.

Short of regulatory reform, the inclusion of statements that specify the key limitations of the risk calculations involved climate modelling could prompt investors to think more critically about what ratings are (and are not) telling them. Such statements, in turn, might guide further action on more transparent risk assessment regulation and investment in more meaningful climate risk reduction. Moreover, additional technical tweaks, such as lengthening the time horizon of rating outlooks, might incentivize external investment in durable adaptation projects. Likewise, the creation of overlapping tiers of ratings could prevent borrowers from suddenly becoming “below investment grade” and thus facing the quick cessation of funding to vital projects. More modestly, central banks could build on tried and tested credit guidance mechanisms to develop green credit policy frameworks which make credit less expensive for investments in adaptation projects.

But de-risking capital can only go so far if the risks held by communities, municipalities, and states that help make up broader capital networks remain unaddressed. As the 2008 crisis made clear, financial markets are only as strong as the individuals who keep them afloat—and climate change will make that increasingly difficult for billions of people to do. To counter the worst effects of the networked climate leviathan sketched here, then, policymakers can and should eliminate debt held by climate-vulnerable nations and leverage legal systems to support sustainable and climate-adaptive economic growth instead of volatile capital flows. The alternative, we wager, is a warmer and more divided planet.