This post is part of a symposium on the political economy of technology. Read the entire series here.

***

What role does technology play in rising inequality? Is it, as the dominant view among policymakers argues, the primary explanatory variable, operating in reasonably efficient markets to shape the value of different workers, and hence the pay they can command? Is it, as labor economists critical of the mainstream imply, a side show, since inequality is overwhelmingly a consequence of political choices that shape bargaining power in markets pervaded by power? If we think that technology matters; that platforms and robots, ubiquitous sensors and algorithms do exert a real influence on the pattern of social relations that make up the economy, but we doubt that technology causes inequality by a “natural” process driven by its own intrinsic affordances and constraints interacting with markets, then we owe ourselves a clearer story than we have given to this point. While the past quarter century has seen a lot of work on technology and freedom, there has been substantially less critical work on economic inequality and technology. In today’s post, I’ll describe the limits of the mainstream economists’ answer, which lies at the foundation of “the robots will take all the jobs” and the legitimation of winner-take-all markets. Tomorrow’s post will outline the limits of the dominant left reaction, as well as the limits of Karl Polanyi’s approach, which has provided so much inspiration for the present resurgence of political economy. Finally, in the third post I’ll outline a view of the political economy of technology.

I see technology as imposing real constraints, and providing meaningful affordances that are sufficiently significant, at least in the short to mid-term, to be a substantial locus of power over the practice of social relations. And yet, technology is neither exogenous nor deterministic, in that it evolves in response to the interaction between the institutional ecosystem and the ideological zeitgeist of a society, such that different societies at the same technological frontier can and do experience significantly different economic and political arrangements. In the short to mid-term, technology acts as a distinct dimension of power enabling some actors to extract more or less than their fair share of economic life; in the long term, technology is a site of struggle, whose shape and pattern are a function of power deployed over the institutional and ideological framework within which we live our lives. The stakes are significant. A left that ignores the implications of technology as a site of meaningful struggle risks falling into a nostalgia for the institutions of yesteryear. But a left that continues to disdain the state and formal institutions, and to imagine that we can build purely technological solutions to inequality risks abandoning the field to the Silicon Valley techno-utopian babble that has legitimated the extractive practices of oligarchy’s most recent heroes.

The most influential economic explanations of rising economic inequality in the past thirty years give a central role to technology, and specifically to the role of skills-biased technical change (SBTC) and the economics of superstars in winner-take-all markets. Both have functioned to naturalize and legitimate emerging patterns of inequality, and to limit the bounds of institutional discussion about the range of feasible interventions that would alleviate inequality while preserving the innovation dynamic on which contemporary rise in standards of living depends. While the details differ, these explanations of inequality share an intellectual framework with current arguments that robots will create structurally high levels of unemployment; that platforms will casualize work; or that algorithms and bots will cause information disorder and polarization.

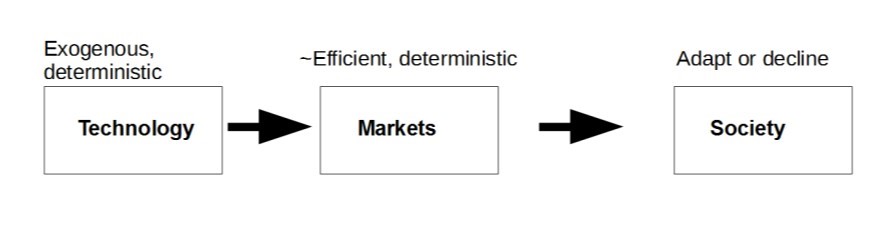

Technology, in these explanations, develops exogenously and interacts with more or less efficient markets to change the relative value of labor, making highly-skilled workers valuable, the super-skilled few superstars, and relegating low- and mid-skilled workers to stagnant or declining wages. (It also is presented as making clickbaity disinformation lucrative – a critical issue that I leave for a different post).

As David, Amy, and Jed’s manifesto at the launch of this blog captured, the theoretical premise of political economy is that “politics and the economy cannot be separated. Politics both creates and shapes the economy. In turn, politics is profoundly shaped by economic relations and economic power. Attempts to separate the economy from politics make justice harder to pursue in both domains.” The role of a political economy of technology is similarly to develop an institutional-political understanding of technology, and to recognize that arguments that treat technology as exogenous and mediated through pre-political and roughly-efficient markets are descriptively mistaken and normatively stultifying.

In its original Katz and Murphy formulation in the early 1990s, SBTC held that more skilled people could take advantage of new technologies and more readily adapt to change, and hence returns to skill, measured in years of schooling, increased monotonically with years of education. This fit US data about rising wage inequality and wage premia to education from the 1980s well. The still-most-widely believed version, which plays a central role in the “robots are taking all the jobs” narrative, is the tasks framework, developed by David Autor and collaborators to address the fact that in the 1990s wages no longer increased monotonically with education, but instead saw an uptick at the bottom and top, and stagnation in the middle. It held that there were both cognitive and noncognitive tasks that were “routine” (pulling a lever at an assembly line; inputing data into a spreadsheet) and these were readily subject to automation; and cognitive and noncognitive nonroutine work (creative accounting; cleaning a messy store room) that were hard to automate. As automation increased, returns to the routine tasks declined, and these turned out to have been the core tasks that made up jobs in the middle of the income distribution.

This framework has been extensively criticized for failing to explain why patterns of distribution changes differed from decade to decade and country to country on the same technological frontier, and although a Paul Krugman can say that the case for SBTC has “largely fallen apart,” it continues to be a central organizing thesis of contemporary policy thinking about inequality and technology. Ever since Sherwin Rosen’s Economics of Superstars, the explanation of the role of technology in the rise of the tippy-top of the income distribution followed a similar logic—technology has permitted the very top of the income distribution to become supervaluable—be it sports stars in a newly global media market or computation-assisted managers with newly-globalized businesses—and the difference between the very best and second best is all the difference that matters to explain the escape of the 1%. Again, there is a lot of evidence to reject this view, which I cover in a good bit of detail in A Political Economy of Oligarchy.

The basic models of SBTC and winner-take-all markets takes technology as exogenous and more-or-less deterministic; that is, it has internally-determined features (such as what is, or isn’t easy to automate, a question the answer to which changes over time based on the internal dynamics of technological progress), and these features emerge from an independent system of development that is almost never part of the analysis. Markets are roughly efficient and deterministic, in that, setting aside noise and imperfections, they price factors of production (including labor) according to their marginal contribution. And so, when technology (independently) makes some tasks easier to automate, markets reflect the declining value of labor that performs automatable tasks, and leads to wage polarization. Ironically, the basic architecture shares a technological determinism reminiscent of the early Marx (“The hand-mill gives you society with the feudal lord; the steam-mill society with the industrial capitalist.)

Society then has the option to adapt well or poorly to these exogenously-determined facts—the changes in technology and the adjustment of markets to the new technological background facts. We can invest in education to make people more suited to the demands of the market; we can tax the skilled to give the unskilled a universal basic income (although the winner-take-all argument suggests that taxing them too much will kill the goose that lays the golden eggs), and so forth.

The most worked out version of this argument is Goldin and Katz’s The Race Between Education and Technology, in which they emphasize that education policy is the primary change between the first two-thirds of the twentieth century—which saw wage compression responding to the movement toward universal high school education—and the last third, which did not see a similar commitment to universal college education that would have been necessary to keep up with technical change, and so education was falling behind in the race with technology, and with it were the wages of the millions who did not continue to improve their skills.

The intellectual framework I draw here is not a straw man, but a necessary intellectual structure without which the empirical predictions that must be tested to examine the claims of SBTC in its various versions make no sense. If markets do not more or less efficiently price the marginal contribution of labor, all things considered, and technology is not more or less exogenous and deterministic in how it interacts with labor, then looking for the causal connection between changes in technology adoption and changes in wage patterns to assess how skills affect the relative value of labor, without accounting for institutional factors that affect wages, is nonsensical.

So, the fundamental problem of the leading mainstream view is that it takes both markets and technology as having a more-or-less natural and necessary shape, and fails to see how institutions shape both markets and technology in ways that can reinforce or moderate patterns of inequality. In tomorrow’s post I’ll outline the primary critiques of this line of work, and how that left critique emphasizes the error associated with the assumptions about the naturalness of markets, but does so only at the cost of leaving technology largely out of the story.