Recovering Contingency within American Antimonopoly and Democracy

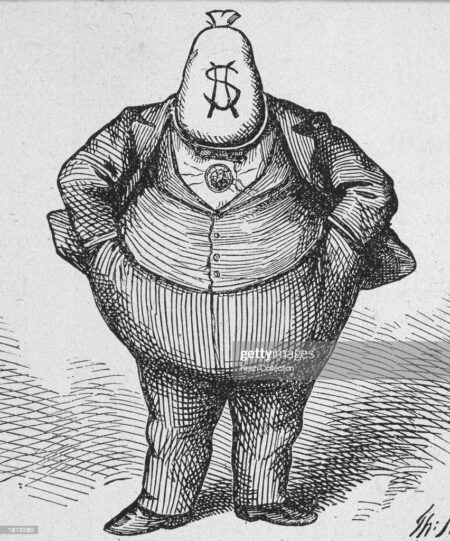

William Novak’s New Democracy demonstrates that the long progressive era was devoted to a reconfiguration of the very nature of modern American capitalism. Yet we must not lose sight of the different visions of state, economy, and democracy that comprised the progressive project.